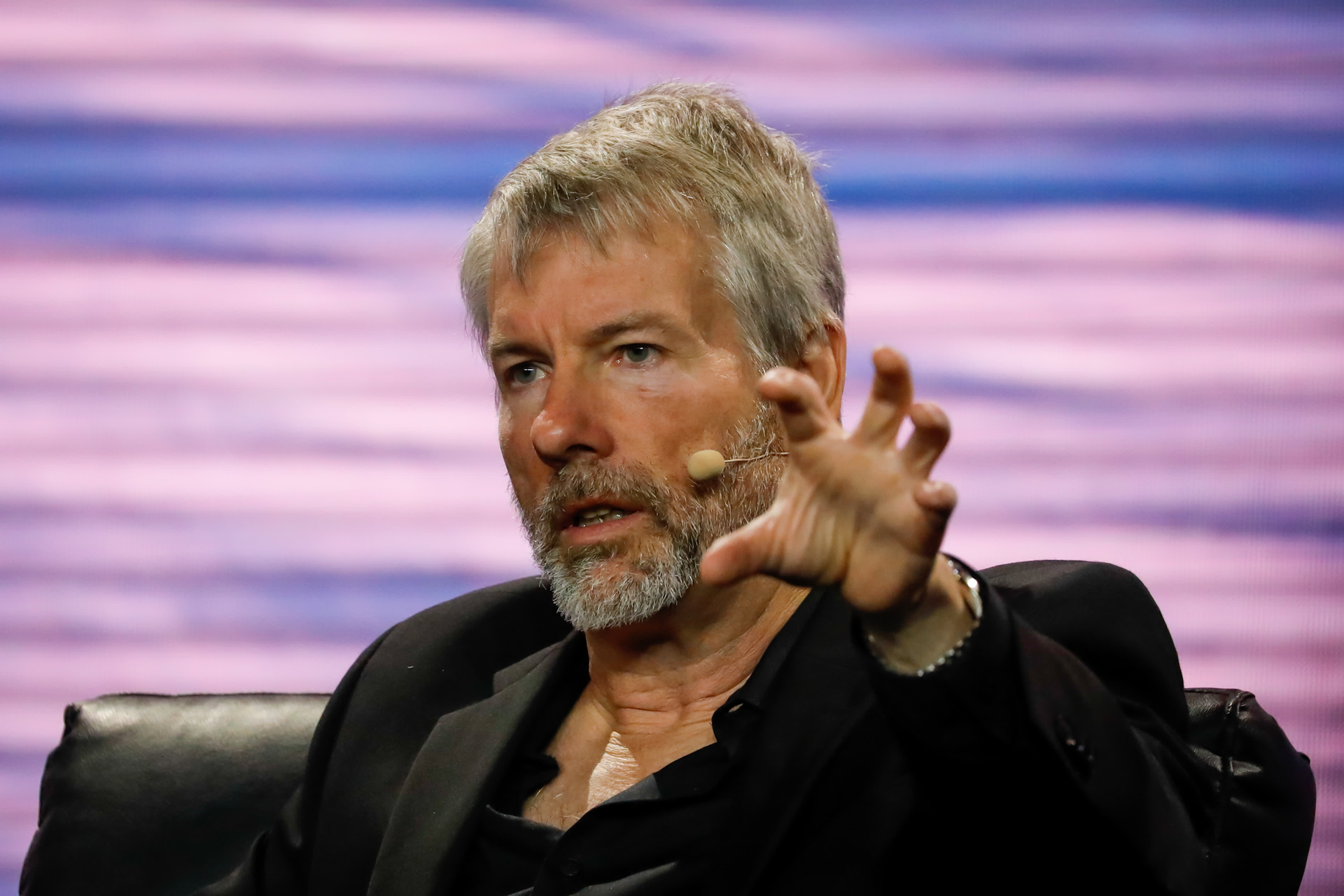

Bitcoin is Forever Money: A Comprehensive Analysis of Michael Saylor's Bitcoin Journey and Insights

Joe Terry • May 26, 2024

Bitcoin is Forever Money: A Comprehensive Analysis of Michael Saylor's Bitcoin Journey and Insights

In the interview

"Bitcoin is Forever Money" on the "What Bitcoin Did" podcast, Michael Saylor,

Executive Chairman of MicroStrategy, offers profound insights into Bitcoin's role in the financial landscape and its transformative impact on his company and personal philosophy. This article expands on the key questions and answers from the interview, providing a thorough understanding of Bitcoin's potential and Saylor's journey with it.

How did you get started with Bitcoin and what prompted this transition?

We began focusing on business intelligence, founding MicroStrategy in 1989. The company went public in 1998 and saw significant success. However, by 2020, Saylor recognized the need for a new strategy to sustain growth and profitability, especially in light of the COVID-19 pandemic and economic upheavals. This led him to Bitcoin, which he viewed as a superior asset for treasury management.

The Evolution of MicroStrategy

The company launched various ventures, some of which were successful, like alarm.com, while others were not. Saylor acknowledged the challenges of maintaining growth and profitability in a highly competitive tech environment.

The pandemic, coupled with zero interest rates and economic uncertainty, prompted Saylor to reassess MicroStrategy's financial strategy. He recognized the limitations of traditional investments and the need for a more robust asset to protect the company's treasury.

The realization that holding cash or low-yield investments was detrimental to MicroStrategy's financial health led Saylor to explore alternatives. Bitcoin emerged as a compelling option due to its non-sovereign, hard money characteristics and its potential to outperform traditional assets in terms of value preservation and growth.

In 2020, Saylor spearheaded MicroStrategy's investment in Bitcoin, purchasing $250 million worth of the cryptocurrency. This move was unprecedented for a publicly traded company and marked a historic shift in corporate treasury management.

The Impact of Bitcoin

While initially met with skepticism, the strategy eventually gained acceptance as Bitcoin's value appreciation validated Saylor's decision. This move not only preserved but significantly enhanced MicroStrategy's financial position, aligning with Saylor's long-term vision.

Bitcoin's introduction to Saylor's financial strategy broadened his understanding of the intersection between finance and technology. He views Bitcoin as both a superior treasury asset and a groundbreaking technology that empowers individuals and corporations alike.

The Broader Implications of Bitcoin

Bitcoin's role in promoting financial sovereignty and empowerment. Saylor believes Bitcoin offers a solution to the inequities created by traditional financial systems, providing individuals with control over their assets and protection against inflation.

Saylor envisions Bitcoin becoming a global standard for storing value, akin to digital gold. He anticipates widespread adoption by individuals, corporations, and even governments as they recognize its benefits.

What challenges did you face in adopting Bitcoin at a corporate level?

Adopting Bitcoin required building consensus among MicroStrategy's board, management, and stakeholders. Saylor had to educate and convince various parties about Bitcoin's potential and address concerns regarding its volatility and regulatory landscape.

Saylor employed a methodical approach to align his team and stakeholders with the Bitcoin strategy, presenting detailed analyses and case studies to demonstrate Bitcoin's viability as a treasury asset. He also ensured transparency and offered shareholders an exit strategy through stock buybacks to mitigate concerns.

The Future of Bitcoin and Financial Markets

Saylor believes that regulatory clarity, technological advancements, and increasing awareness of Bitcoin's benefits will drive adoption. He highlights the approval of Bitcoin ETFs and changes in accounting guidelines as pivotal moments for institutional adoption.

Saylor sees Bitcoin as a cornerstone of the digital financial revolution, combining the best aspects of technology and monetary principles. He compares it to historical technological advancements that have reshaped economies and societies.

The Strategic Vision for Bitcoin

Saylor took a detailed and methodical approach to educate his team and stakeholders. He provided comprehensive analyses, historical context, and case studies to illustrate Bitcoin's potential. Saylor also emphasized the importance of transparency and offered shareholders an exit strategy through stock buybacks, which helped mitigate concerns about volatility and risk.

The key factors that convinced us to proceed with Bitcoin included Bitcoin's proven track record as a store of value, its potential for significant appreciation, and its role as a hedge against inflation and economic uncertainty. Additionally, Bitcoin's decentralized nature and technological underpinnings made it an attractive asset for long-term strategic investment.

The Broader Economic Context

Bitcoin's role in the broader economic landscape particularly in the context of a rapidly digitizing global economy. He believes Bitcoin offers a unique combination of stability, security, and growth potential that is unmatched by traditional financial assets.

The potential challenges and opportunities for Bitcoin in the global economy include regulatory hurdles, market volatility, and the need for broader adoption and acceptance. However, the opportunities are vast, including increased financial inclusion, protection against currency devaluation, and the potential to reshape global financial systems.

Personal and Philosophical Reflections

Saylor’s involvement with Bitcoin has changed his philosophy and outlook profoundly and impacted his personal philosophy and outlook. He now views Bitcoin not just as a financial asset, but as a transformative technology with the potential to empower individuals and promote financial sovereignty. This shift has reinforced his belief in the importance of innovation and strategic thinking in navigating complex economic landscapes.

Saylor advises business leaders to approach Bitcoin with an open mind and a willingness to learn. He emphasizes the importance of thorough research, strategic planning, and building consensus within the organization. Saylor also highlights the need for transparency and clear communication with stakeholders to address concerns and build trust.

In-Depth Insights: Exploring Key Themes and Takeaways

Saylor's extensive experience in business intelligence and technology provided a solid foundation for understanding Bitcoin's potential. His ability to analyze complex data and trends allowed him to see the value in Bitcoin as a strategic asset, setting the stage for MicroStrategy's groundbreaking investment.

Saylor is particularly drawn to Bitcoin's decentralized nature and its robust security model. He appreciates the technological innovation behind Bitcoin, including its use of blockchain technology and cryptographic principles, which make it a resilient and transparent system for storing and transferring value.

How does Bitcoin align with your broader vision for MicroStrategy's future?

Saylor views Bitcoin as an integral part of MicroStrategy's future, not just as a financial asset but as a strategic tool for innovation and growth. He believes that integrating Bitcoin into the company's financial strategy will position MicroStrategy as a leader in the emerging digital economy.

Navigating the Regulatory Landscape

Saylor acknowledges the challenges posed by regulatory uncertainty but remains optimistic about the future. He believes that as more institutions and governments recognize Bitcoin's value, regulatory frameworks will evolve to support its adoption. Saylor advocates for clear and fair regulations that protect investors while fostering innovation.

Saylor addresses concerns about Bitcoin's environmental impact by stressing the importance of sustainable practices in Bitcoin mining. He points out that the industry is increasingly adopting renewable energy sources and improving efficiency. Saylor argues that Bitcoin's environmental impact should be viewed in the context of its broader benefits, including financial inclusion and economic empowerment.

How do you see Bitcoin contributing to financial inclusion and social equity?

Saylor believes that Bitcoin has the potential to democratize access to financial services, particularly in regions with limited banking infrastructure. By providing a secure and accessible means of storing and transferring value, Bitcoin can empower individuals and communities, fostering economic growth and social equity.

Saylor believes that Bitcoin has the potential to democratize access to financial services, particularly in regions with limited banking infrastructure. By providing a secure and accessible means of storing and transferring value, Bitcoin can empower individuals and communities, fostering economic growth and social equity.

Saylor highlights Bitcoin's ability to serve as a hedge against inflation, especially in countries with unstable currencies. By holding Bitcoin, individuals can protect their wealth from devaluation, thereby reducing economic disparities. This is particularly impactful for those in developing nations, where traditional banking systems may be unreliable or inaccessible.

Saylor views Bitcoin as a tool for enhancing individual sovereignty by giving people control over their financial assets. Unlike traditional financial systems, which are often subject to governmental and institutional control, Bitcoin allows individuals to manage their wealth independently. This aligns with Saylor's broader vision of financial empowerment and self-sovereignty.

Strategic Considerations for Bitcoin Adoption

Saylor describes the key strategic considerations for companies looking to adopt Bitcoin. He advises companies to thoroughly understand Bitcoin's underlying technology and market dynamics. He emphasizes the importance of developing a clear investment thesis and educating stakeholders about Bitcoin's benefits and risks. Companies should also consider regulatory compliance and risk management strategies to navigate the evolving landscape.

Saylor recommends a balanced approach to Bitcoin investment, incorporating it as part of a diversified portfolio. He suggests that companies should focus on long-term value creation rather than short-term price fluctuations. By maintaining a clear strategic vision and managing risk effectively, companies can leverage Bitcoin's potential while mitigating volatility.

The Role of Leadership in Bitcoin Adoption

Saylor underscores the importance of visionary leadership in driving Bitcoin adoption. Leaders must be willing to challenge conventional wisdom and embrace innovative solutions. Effective communication, education, and consensus-building are crucial for gaining stakeholder support and successfully implementing a Bitcoin strategy.

How can leaders foster a culture of innovation and adaptability in their organizations? Saylor advocates for a culture that encourages continuous learning and experimentation. Leaders should create an environment where employees feel empowered to explore new ideas and technologies. By fostering a mindset of innovation and adaptability, organizations can better navigate the rapidly changing technological landscape.

The Future of Bitcoin in a Digital Economy

Saylor envisions Bitcoin as a foundational asset in the emerging digital economy. He believes that Bitcoin's adoption will accelerate as more individuals, companies, and governments recognize its value. In the long term, Saylor sees Bitcoin playing a central role in a decentralized financial system that promotes transparency, security, and inclusivity.

Bitcoin will complement other emerging technologies, such as artificial intelligence and blockchain-based applications. These technologies have the potential to enhance Bitcoin's functionality and integration into various sectors, from finance to supply chain management. By working together, these innovations can drive the next wave of technological advancement.

Educational Initiatives and Advocacy

Saylor has been actively promoting Bitcoin understanding and adoption, promoting Bitcoin education through various educational initiatives, including the Saylor Academy. The academy offers free courses on Bitcoin, blockchain technology, and related topics to help individuals and organizations better understand the cryptocurrency landscape. Saylor also participates in conferences, webinars, and podcasts to share his insights and advocate for Bitcoin adoption.

Saylor encourages individuals and organizations to engage with the Bitcoin community through online forums, social media, and industry events. Staying informed about regulatory changes, technological advancements, and market trends is crucial for making informed decisions. Additionally, leveraging educational resources and participating in discussions can help build a deeper understanding of Bitcoin's potential and challenges.

Conclusion

Michael Saylor's journey with Bitcoin underscores the transformative potential of cryptocurrency in modern finance.

This expanded article captures the essence of Saylor's interview on "What Bitcoin Did," offering a comprehensive overview of his perspectives and the significant impact of Bitcoin on his career and worldview. Through detailed questions and answers, it provides a thorough understanding of Bitcoin's potential and the strategic vision that drives Saylor's continued advocacy for this groundbreaking technology.

By embracing Bitcoin, Saylor not only revitalized MicroStrategy's financial strategy but also became a prominent advocate for Bitcoin's broader societal benefits. His insights provide a compelling case for Bitcoin as a strategic asset and a catalyst for financial empowerment.

Final Thoughts: The Legacy of Bitcoin and Saylor's Vision

Saylor hopes to be remembered as a pioneer who recognized the transformative potential of Bitcoin and championed its adoption. He aspires to leave a legacy of innovation and financial empowerment, contributing to a future where individuals and organizations can thrive in a decentralized, transparent, and equitable financial system.

Saylor encourages the next generation to be fearless in their pursuit of innovation and to embrace the disruptive potential of new technologies. He emphasizes the importance of lifelong learning, adaptability, and a commitment to making a positive impact on the world. By staying curious and open-minded, future leaders can drive meaningful change and shape a better future for all.

Michael Saylor's insights and experiences offer a powerful testament to the transformative power of Bitcoin and the importance of visionary leadership in navigating the complexities of the modern financial landscape. His journey serves as an inspiration for individuals and organizations looking to harness the potential of Bitcoin and other emerging technologies to build a more inclusive, transparent, and resilient economy.

The 21 Rules of Bitcoin: A Philosophical Journey In his BTC Prague 2024 keynote, Michael Saylor frames his conversation by highlighting Bitcoin as a profound intersection where science meets economics. He draws parallels to historical moments where scientific advancements dramatically shifted our understanding of the world, such as the Copernican Revolution in astronomy and the realization that diseases are not caused by demons but by germs in medicine. Saylor positions Bitcoin as a similarly transformative force, describing it as the world's first perfect money. He contrasts Bitcoin with the defective forms of money humanity has used throughout history, such as seashells, tobacco, glass beads, copper tokens, and paper currencies. He envisions a future where people will look back and chuckle at these primitive forms of money, marveling at how far humanity has come. Saylor explains that the concept of perfect money is a paradigm shift. He uses the analogy of falling through space to illustrate the idea of relativity, suggesting that everything around us is distorted until we adopt a new frame of reference. Just as Einstein's theory of relativity changed our understanding of physics, Satoshi Nakamoto's invention of Bitcoin introduces a new paradigm in economics and monetary thought. This paradigm shift, according to Saylor, will profoundly change our political systems, financial systems, and overall worldview. With this philosophical and economic foundation laid, Saylor transitions to presenting his "21 Rules of Bitcoin."