Digital Transformation is the Best Technology Idea for Today: It is the evolution of Money

In his recent presentation "Bitcoin, There Is No Second Best," Michael Saylor, Executive Chairman of MicroStrategy, Inc.(https://www.microstrategy.com) shared why he believes Bitcoin is the ultimate crypto asset. He used data, slides, and examples that position Bitcoin as the best digital transformation idea, network, investment brand, and commodity. In this post we are going to delve into his comprehensive reasoning and try to convince you that he is right and you should learn more.

Digital Transformation and Economic Energy

Michael Saylor begins by setting the stage with a slide titled "Digital Transformation and the Best Ideas." He emphasizes that the concept of digital transformation has reshaped the modern world. Companies like Microsoft, Apple, Google, and Nvidia have pioneered digital books, entertainment, intelligence, and communications. Through this dematerialization of products, from records to libraries, unparalleled economic energy and efficiency have been created.

Saylor compares the market returns of the top seven digital transformation companies to the rest of the S&P 500. He explains that the companies that led the digital transformation delivered extraordinary returns, while the remaining 493 companies in the S&P 500 had minimal returns. Investors who backed these transformations have seen massive gains, and the companies themselves have become as influential as nation-states.

Bitcoin as the Best Crypto Asset

The recent approval of Bitcoin spot ETFs underscores Bitcoin's growing legitimacy.

Additionally, Bitcoin's network security is unmatched due to its unparalleled hash rate, which continues to grow by 70% annually, even during bear markets. This creates an unstoppable and secure network, supported by the power of ASIC chips and a decentralized mining operation driven by electricity consumption worldwide.

Slide Reference: "Hash Rate Growth and Network Security"

Bitcoin as the Best Crypto Network

With 220 million holders and universal recognition across the crypto industry, Bitcoin is poised to absorb capital as other crypto projects face regulatory and competitive challenges.

As other crypto networks fail due to competition, regulation, or entropy, their capital will flow into Bitcoin.

Bitcoin as the Best Investment Brand

He likens Bitcoin to a sports team with hundreds of millions of passionate fans. The brand recognition, coupled with Bitcoin's technological features, has made it a cultural phenomenon. Whether it’s the person in the yellow vest at an airport or the billionaire in a boardroom, Bitcoin has captured the attention and loyalty of a diverse, global audience.

Bitcoin as the Best Digital Commodity

Bitcoin is the only crypto asset recognized as an asset without an issuer by all major regulators worldwide. This concept, which Saylor calls the "Immaculate Conception," is where Satoshi Nakamoto created, gave away, and then walked away from Bitcoin, making it unique.

Its fixed supply, portability, divisibility, and programmability make Bitcoin a superior store of value compared to traditional commodities like gold. Over the last four years, Bitcoin has provided a 394% return compared to gold's 133%.

Bitcoin vs. Other Commodities

Saylor explains that commodities often make poor investments due to supply fluctuations. However, Bitcoin stands out due to its digital nature and fixed supply, making it resilient against inflation. He highlights that Bitcoin's nature as a digital commodity with a fixed supply sets it apart from traditional commodities.

Bitcoin's Position in Digital Transformation

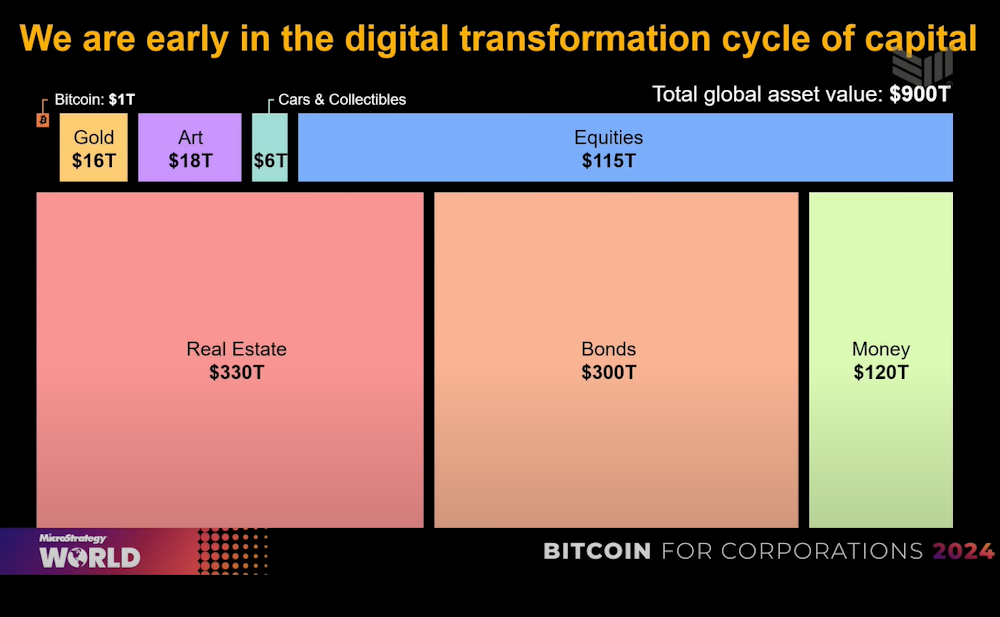

Saylor then shifts the conversation to Bitcoin's position in the digital transformation landscape, presenting a slide titled "Digital Capital and the Next Phase of Digital Transformation." He explains that Bitcoin represents the next phase of digital transformation, focusing on digital capital, property, and money. With only 0.1% of the world's $900 trillion in assets currently digital, he highlights a vast opportunity for Bitcoin's growth.

Saylor firmly believes that Bitcoin stands as the best idea in this wave of digital transformation due to its ability to create digital capital via crypto proof-of-work. This mechanism allows Bitcoin to be a decentralized and sovereign asset, directly linked to the real world through electricity and silicon.

Bitcoin's Future and Institutional Adoption

Saylor believes institutional adoption, regulation, and technological innovations like Taproot and Schnorr signatures will propel Bitcoin's growth. With an increasing number of institutions adding Bitcoin to their balance sheets and investment portfolios, Bitcoin is becoming a standardized economic solution for billions of people.

Ultimately, Michael Saylor asserts that Bitcoin is the best digital transformation idea, crypto asset, network, investment brand, and digital commodity. There is no second best because Bitcoin's combination of features, security, and universal acceptance makes it unrivaled in the crypto ecosystem.

We provide educational Seminars on Bitcoin and other Cryptocurrencies. If you don’t find the subject or Cryptocurrency Seminar you want, ask us to create one.

Bitcoin and Cryptocurrency Education Classes Available